January 1st kicked off 2017 with significant gasoline price hikes at the pumps courtesy the Ontario Liberal government’s cap and trade legislation. I obviously voted against that bill.

Ontario’s cap and trade, Canada’s price on carbon

Another reality is that Canada is putting a price on carbon, the nature of which is still being negotiated with the provinces. With national carbon pricing being the new reality, Opposition Leader Patrick Brown has written an open letter to Justin Trudeau indicating that Kathleen Wynne’s cap and trade law “does not have Ontario’s best interests at heart,” and requesting that Ontario cap-and-trade be removed from the Trudeau carbon pricing system. I’m not holding my breath on that one.

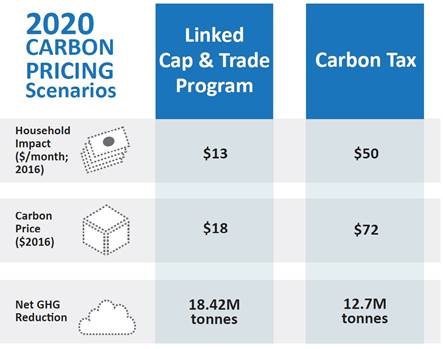

The problem with the provincial cap and trade tax and the federal price on carbon is that going electric is neither technologically nor economically feasible for most, thanks to the Ontario Liberal’s Green Energy Act. I also voted against that bill. The cap and trade tax system serves as a stick to try and modify behavior without offering a viable alternative and without a carrot to reward changes made, other than using the revenue for more subsidies for things like electric cars and Toronto transit.

As Ontario’s Official Opposition we have committed to dismantle the cap and trade system ever bearing in mind the federal government is mandating all provinces put a price on carbon.

On January 1, the province capped greenhouse emissions and will sell allowances to companies who have to exceed the cap. The province will lower the cap over time. Companies exceeding their cap can also buy additional allowances, or if they come in below their annual limit, can sell their emission allowances to other companies within a market comprised of Ontario, Quebec and California.

It is estimated Ontario businesses will be paying $300 million a year to California.

We maintain the government is so desperate to hike taxes, they have rejected a revenue-neutral plan – cap-and-trade money will disappear into general revenues.

Cap and trade has clearly not been designed to return money to those paying – it is a blatant $2 billion-a-year tax grab under the guise of environmentalism. It will seriously impact everyone’s pocket book. Oil refineries for example will pass their recovery costs of cap and trade to their customers at the pumps. It subtracts money from people, not only for gasoline, diesel, propane, natural gas, heating oil and aviation fuel but also for groceries, clothing and other consumer goods produced and delivered by carbon-fueled plant, equipment and transportation.

Ontario’s Auditor General reports the cap and trade tax will cost families an extra $156 this year for gasoline and natural gas, rising to $210 by 2019. Added transportation costs for goods and services will be another $75 per household by 2019.

We are committed to dismantling the cap and trade scheme and the Green Energy Act. This is the best way to ensure people’s hard-earned money stays exactly where it should stay…in their pockets.

In conclusion, I ask you the reader – where do we go from here? There probably won’t be an election until June 2018 and this is the time to consult on policy.

Provincially, the Ontario PC Party has committed to dismantle the Wynne cap and trade law, as well as the Green Energy Act. However, carbon pricing is now the reality in Canada and Ontario will be bound by the Trudeau price on carbon. For the Silo, Haldimand-Norfolk MPP Toby Barrett.

Leave a Reply

You must be logged in to post a comment.