[See Comments at the end of this article for updates Ed.] “All my pension goes to pay my electricity” – constituent. With Ontario boasting the highest energy prices in North America, quite honestly I don’t know how some people get by. When people bring their electricity bills into my office, it provides a line-by-line window on just how difficult it has become to pay the bills.

Recently I met with a couple who live in a modest 790 square foot house – they heat with one electric space heater, have been wearing heavy sweaters all winter and are doing absolutely everything they can to keep costs down. But their hydro bill for January was $641.67 — $233.89 of which was delivery charge. During the meeting I was told: “All my pension goes to pay my electricity.”

Nowadays if you can’t afford your electricity, in many cases, you don’t have the option of paying interest or getting caught up later – your service is simply shut off. To have service reconnected is often hundreds of dollars. If someone can’t afford their bills in the first place how will they ever be able to pay exorbitant fees for reconnection? Apart from closing down cheap coal generation, there are many reasons why hydro has skyrocketed.

For example, the Feed-in-Tariff (FIT) Program pays out massive subsidies for wind and solar contracts to produce power we don’t need. This continues to drive up the cost of electricity which rose by 26 per cent between 2008 and 2010 – projected to rise another 46 per cent by the end of this year. The FIT Program, with its overly-generous payments, will cost taxpayers $4.4 billion more than the previous Standard Offer Program. Wind generators operate at 28 per cent capacity and their output is out of phase with electricity demand during certain times of the day.

You can’t store electricity, so we pay the U.S. and Quebec to take the surplus power off our hands. We’ve paid them $1.8 billion over the past six years. Their industries use this cheap power to compete even harder with our manufacturers, and so the downward spiral continues.

If you’re a large user, look for the words ‘Global Adjustment’ on your hydro bill. Simply put, Global Adjustment covers the spread between market price and guaranteed price paid to generators, plus the cost of paying standby natural gas plants not to produce electricity, as well as paying for conservation programs. One North Bay manufacturer had a Global Adjustment — nonexistent on their 2009 hydro bills — of $1,700 on their electricity charge of $1,400 for that month. The Global Adjustment is expected to increase tenfold, from $700 million in 2006 to $8.1 billion in 2014. This will certainly cause more Ontario manufacturers to close up shop and move to cheaper locales.

Also, watch for the Smart Meter charges to hit home. The computer system cost $250 million, and the bill is now due.

Let’s not forget the cancellation of the Oakville power plant and cancelling, demolishing and relocating the Mississauga power plant. These cancellations were nothing more than political ‘seat savers’ for the last election and will cost taxpayers $1.1 billion.

In many ways the Green Energy Act put the desires of the renewable power industry ahead of the needs of people and Ontario businesses – a perfect formula for killing jobs and crippling consumers. For the Silo, MPP Toby Barrett

DID YOU KNOW?- Norfolk Power (and in fact all Ontario Municipal power companies to the best of our knowledge-CP) has a 13 days past due policy for Service Termination Proceedings. Even small “ma and pa” businesses provide 30 day terms and even 60-90day terms before sending out Collection Letters or Warning Letters. We contacted Norfolk Power and were told that “it’s standard policy- set by Ontario’s Energy Board”. Hmmm- that sounded like a standard “sub-standard” explanation to us, so a bit of research showed that the Ontario Energy Board is a self-regulated, internally filled board that sounds impartial but is anything but- in fact we were unable to determine exactly who or how board positions are filled, never a good sign for impartiality. If you decide to call them at 416 481 1967 be ready for one of the most confusing answering services you will ever find. Messages prompt you with a never ending supply of websites and telephone numbers- finally if you are persistent enough you will be asked to “press 9” to consent for your personal information to be gathered, recorded and used by the Ontario Energy Board- not exactly consumer friendly. I suppose you could always speak with one of the Public Information Officer but then they will refer you to media relations. You won’t be transferred (we were told they aren’t allowed to) so keep a document open and handy- 416 544 5171 and then the process begins again only this time you are immediately connected with an answering machine asking for your credentials. *sigh Fifteen minutes later from when we started our initial inquiry we realized we might as well be prospecting for dare we say it “oil”. [Update- Many Municipal aka “County” Hydro companies including Norfolk Power have sold their electricity services to Hydro One but have held onto their Water services. Ontarians will now receive a separate bill for Water and a separate bill for electricity. Perhaps more confusing, in Spring of 2015 Ontario announced that it would sell 15% of its Hydro One holdings in an IPO plan that will eventually sell off another 45% in order to raise money for debt repayment, transportation and infrastructure programs. Targeted buyers would be Canada’s largest pension plans. http://www.bloomberg.com/news/articles/2015-04-16/ontario-to-sell-15-of-hydro-one-one-of-biggest-ipos Ed. ]

If you have the brain power – take a look at this excerpt from the Energy Board’s website- listing (in broad terms) changes to Ontario’s energy act- which ultimately affects consumers in Ontario and their payment and use of energy:

|

1907-1959 |

|---|

| The Natural Gas and Oil Wells Act marked the Province’s early concern for the proper management of its energy resources – a concern that evolved through the Natural Gas Act of 1918, the Natural Gas Conservation Act of 1921 and the Ontario Fuel Board Act of 1954. |

|

1960-1998 |

| The Ontario Energy Board Act, 1960 created the Ontario Energy Board (OEB) as a successor to the Ontario Fuel Board. The OEB was authorized to set just and reasonable rates for the sale and storage of gas and to make orders granting leave to construct pipelines for the transmission of oil or gas to expropriate land for oil or gas pipes.The Ontario Energy Act, 1964 clarified certain powers of the OEB and strengthened the sections dealing with gas storage. An amendment to this Act in 1965 set out the ground rules for the OEB in determining the rate base of gas utilities and giving the OEB power to make regulations prescribing a uniform system of accounts for gas companies.On June 7, 1973, the Premier announced the establishment of the Ministry of Energy which would include the OEB. Further amendments were made to the Ontario Energy Board Act which included provisions for the appointment of additional board members and making the OEB responsible for annual reviews of rate and rate-related matters of Ontario Hydro.In the late 1960s and early 1970s, the oil crisis developed in the Middle East, causing natural gas prices to soar. Ontario Hydro turned to nuclear generation and the public became conservation conscious. During that time, the Board decided on hundreds of natural gas applications and conducted major reviews of Ontario Hydro rates. |

|

1998 |

| The mandate of the Board changed significantly with the passage of the Energy Competition Act, 1998 (ECA) The ultimate goal of the ECA was the creation of a competitive market in the electricity and natural gas industries.To achieve the goal of creating a competitive market in the electricity industry, the former Ontario Hydro monopoly was replaced by several business entities including two distinct commercial companies, Ontario Power Generation (OPG) and Hydro One Inc., and one Crown corporation, the Independent Electricity Market Operator, now known as the Independent Electricity System Operator (IESO). OPG has taken responsibility for the generation of electricity while Hydro One owns and maintains transmission and distribution wires. The IESO manages the province’s electricity system and operates the wholesale electricity market. The OEB had varying degrees of regulatory authority over all three corporations as well as the province’s municipal electric utilities.The OEB became responsible for regulating local distribution companies and for ensuring that the distribution companies fulfill their obligations to connect and serve their customers. The OEB also became responsible for licensing certain participants in the market. The OEB regulated all market participants in the province’s natural gas and electricity industries and it provided advice on energy matters referred to it by the Minister of Energy and/or the Minister of Natural Resources. |

|

2002 |

| On May 1, 2002, Ontario’s new electricity market opened. The new market was the culmination of over five years of work by the electricity industry, government, the OEB, the IESO and many other market participants. The generation of electricity became a competitive activity, with electricity bought and sold on the new spot market at competitive prices. The IESO successfully began operating the wholesale market.Over the summer of 2002, record-high temperatures drove up the demand for electricity as well as the market price, which resulted in considerable consumer concern. In response, the government introduced the Electricity Pricing, Conservation and Supply Act, 2002. This legislation, which received Royal Assent on December 9, 2002, capped the price of electricity at 4.3 cents per kilowatt hour for residential, small-business and other designated low-volume consumers, effective May 1, 2002 to May 1, 2006. This legislation also provided refunds, retroactive to May 1, 2002, to compensate those consumers for any costs in excess of the 4.3-cent cap.All transmission and distribution rates were frozen at existing levels until at least May 1, 2006. Utilities were required to receive written approval from the Minister of Energy before any application for rate changes could be submitted to the OEB. This legislation also deemed any interim rate order to be final. In addition, the new legislation modified the OEB’s objectives in the areas of energy efficiency and conservation with respect to both natural gas and electricity from “facilitating” to “promoting.” |

|

2003 |

| Proclaimed on August 1, 2003, the Ontario Energy Board Consumer Protection and Governance Act, 2003, established the new OEB as a self-financing crown corporation and gave the OEB the opportunity to do its work more efficiently and effectively. In particular, the legislation provided for a management committee to manage the activities of the OEB. The legislation further enhanced the OEB’s role in protecting and educating energy consumers.In December 2003, the government introduced the Ontario Energy Board Amendment Act (Electricity Pricing), 2003, which put in place a new interim electricity pricing structure, replacing the 4.3 cent per kilowatt hour (kWh) price cap as of April 1, 2004. Under the interim structure, residential, low-volume and other designated consumers paid 4.7 cents per kWh for the first 750 kWh consumed per month, and 5.5 cents per kWh for consumption above that level.The Act called on the OEB to develop a new electricity pricing mechanism. It also charged the OEB with the responsibility to protect and renew Ontario’s electricity grid by ensuring reasonable charges for the delivery of electricity.The legislation also required the OEB to allow local distribution companies to recoup costs (called “regulatory assets”), the recovery of which had been put on hold in 2002 by the Electricity Pricing, Conservation and Supply Act, 2002. These recoveries would be spread over a four-year period so that they would have only a modest impact on the final price to consumers. |

|

2004 |

| In June 2004, the Government of Ontario proposed a restructuring of the province’s electricity sector in order to encourage new electricity supply, energy conservation and stable prices at a level reflecting the true cost of electricity.The Electricity Restructuring Act, 2004, received Royal Assent on December 9, 2004. The new legislation amended the Ontario Energy Board Act, 1998, and the Electricity Act, 1998.The OEB became responsible for developing a transparent mechanism for establishing electricity commodity prices for eligible consumers who have not signed contracts with electricity retailers. The Regulated Price Plan, which took effect May 1, 2005, replaced the interim two-tier pricing of 4.7 cents per kilowatt hour (¢/kWh) and 5.5 ¢/kWh hour that had been in place since April 2004.The OEB also assumed responsibility for the Market Surveillance Panel, previously the responsibility of the IESO.A new agency, the Ontario Power Authority (OPA), was established to ensure an adequate, reliable and secure supply of electricity in Ontario for the medium and long term. The OEB was given the duty of approving the OPA’s fees and its integrated power system plan and procurement process. The OEB is also responsible for licensing the OPA. |

|

2009 |

The Green Energy and Green Economy Act, 2009 received Royal Assent on May 14, 2009. Among other things, the legislation amended the Ontario Energy Board Act, 1998 and the Electricity Act, 1998. It established important responsibilities for the OEB and other entities in achieving the objectives of conservation, promotion of renewable generation, and technological innovation through the smart grid.The OEB’s three new objectives are:

The OEB has an important role to play in ensuring the government’s objectives in the legislation are achieved. That includes ensuring that electricity distributors meet the requirements for renewable generation connection, smart grid implementation and conservation and demand management. |

|

2010 |

| In 2010, Ontario passed the Energy Consumer Protection Act, that would ensure Ontarians have the information they need about electricity contracts and bills, as well as the comfort of knowing they can rely on fair business practices. The new rules come into effect in January 2011. |

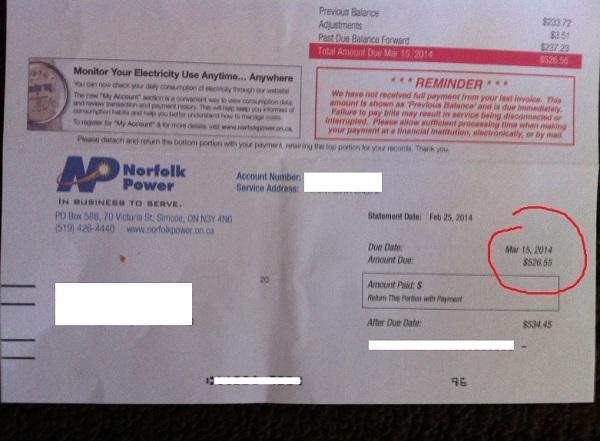

Silo reader “Jack” sent us this scan of his hydro bill- over 500$ for two months of service for a small 2 Bedroom basement apartment. Notice that he was unable to pay his bill on time due to the fact that his bill accounted for almost 50% of his rent.

Leave a Reply

You must be logged in to post a comment.